Task Force on Climate-related Financial Disclosures ,TCFD

The World Economic Forum (WEF) released the Global Risks Report 2024 on January 10, 2024. The report indicated widespread concerns about the future. Environmental risks ranked high for 2024 and in both short-term and long-term risk perceptions. Social extremism and the development of artificial intelligence (AI) make obtaining the “truth” challenging, and geopolitical and economic divisions make global cooperative governance a difficult task. However, taking actions from various dimensions and working together to reduce global disaster risks remains the best solution.

2023 is almost certain to be the warmest year on record. The Secretary-General of the United Nations has called attention to the urgency of the issues in July and September by using the terms “the era of global boiling” and “climate breakdown.” During this time, extreme disasters brought about by climate change have caught many parts of the world off guard, such as the floods in Libya in September, which caused over 6,000 deaths, and the rarely seen wildfires in Hawaii in August, which burned 878 hectares of land and resulted in nearly 100 deaths.

The 28th United Nations Climate Change Conference (COP28) was held in Dubai, United Arab Emirates, from November 30 to December 12, 2023. Key resolutions are as follows:

- Transitioning away from fossil fuels in energy systems and committing to phasing out inefficient fossil fuel subsidies.

- Triple renewables by 2030 compared to the base year of 2022, and double the average energy efficiency annually.

- Establish a Loss and Damage Fund to aid developing countries affected by climate disasters.

- Accelerate the reduction of methane leaks and road traffic carbon emissions (vehicle electrification).

UVB stay highly attentive of our climate change risks and opportunities to ensure that we can fulfill our responsibilities to society, the environment, and all our stakeholders. All members of our management team from our chairman to senior managers consider climate change to be an important corporate issue and work to monitor and manage climate topics using an effective governance framework.

Board of Directors of UVB serve as the highest governing body to drive corporate sustainability. Guided by principles of ethical business conduct and the protection of shareholder interests, the board oversees a broad spectrum of environmental risks and opportunities, including those related to climate change impacts.

In order to implement sustainable measures, the Board of Directors approved the “Sustainable Development Best Practice Principles” and established ESG Office to carry out various sustainability actions.

In terms of climate action, the Office acts as a platform for horizontal connection and vertical integration, self-management completed 2023 greenhouse gas inventory and disclosure, and the converted total emissions are as follows:

Assess potential climate-related risks and opportunities based on the responsibilities of each group, formulate countermeasures, plan and execute greenhouse gas inventories and disclosures, and regularly track the performance of carbon reduction targets.

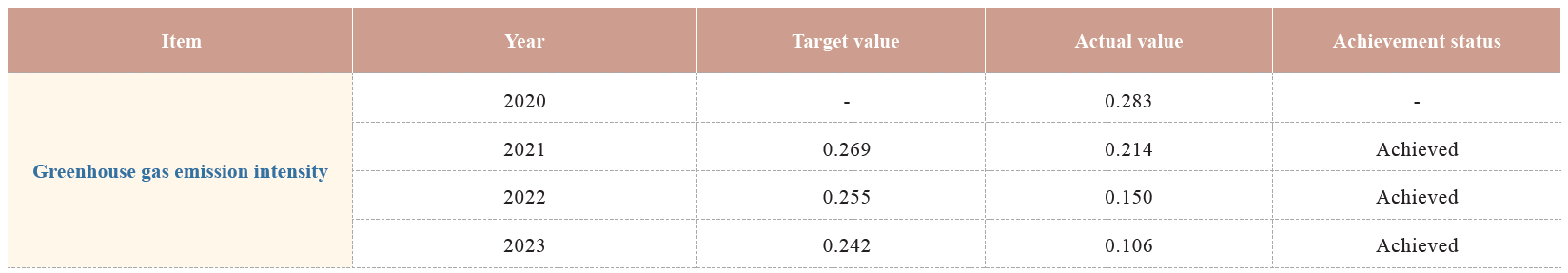

Status of achieving greenhouse gas reduction management targets, with 2020 as the base year:

02 Strategy

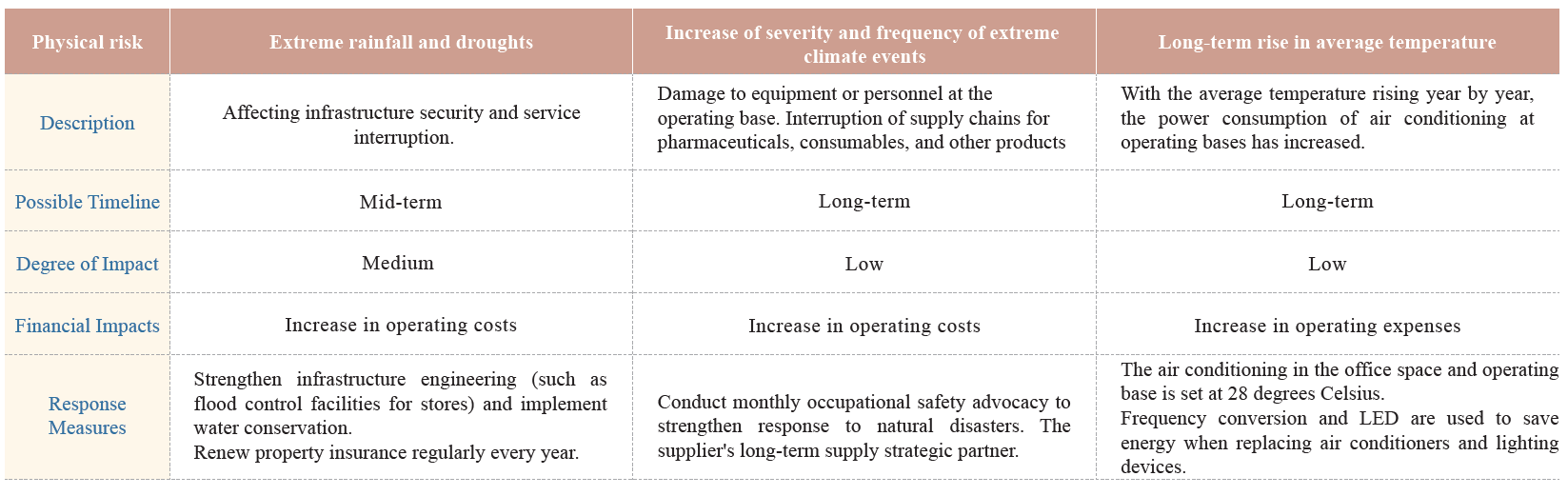

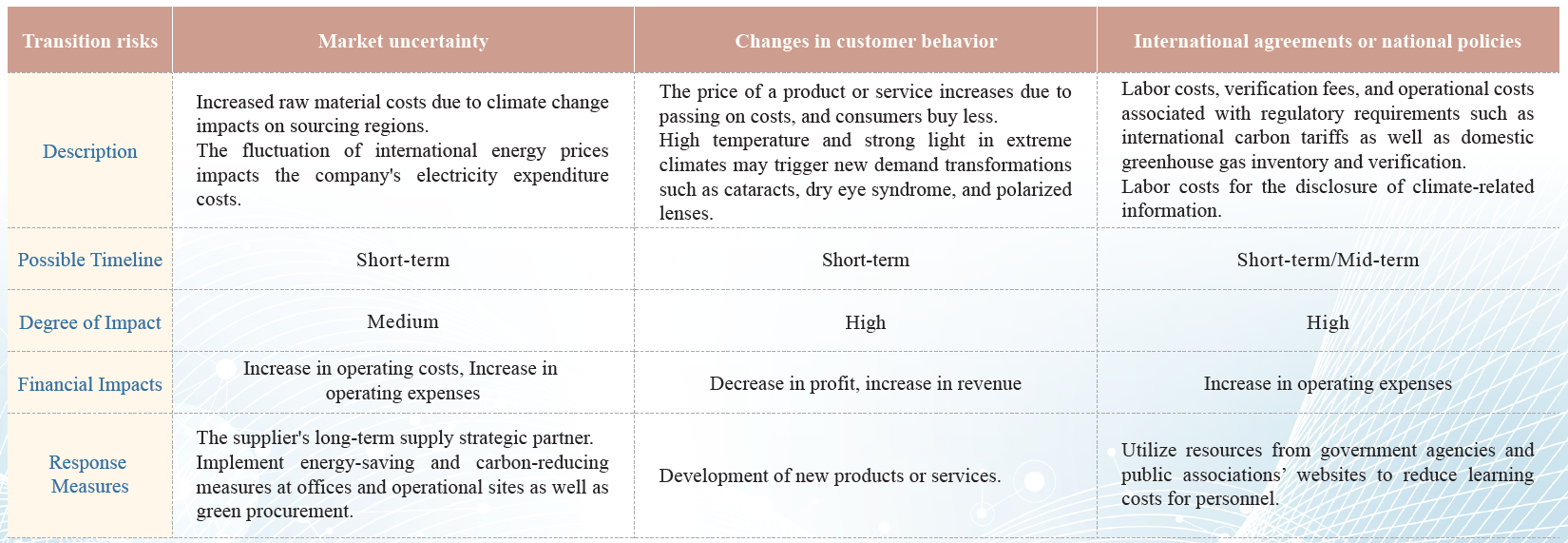

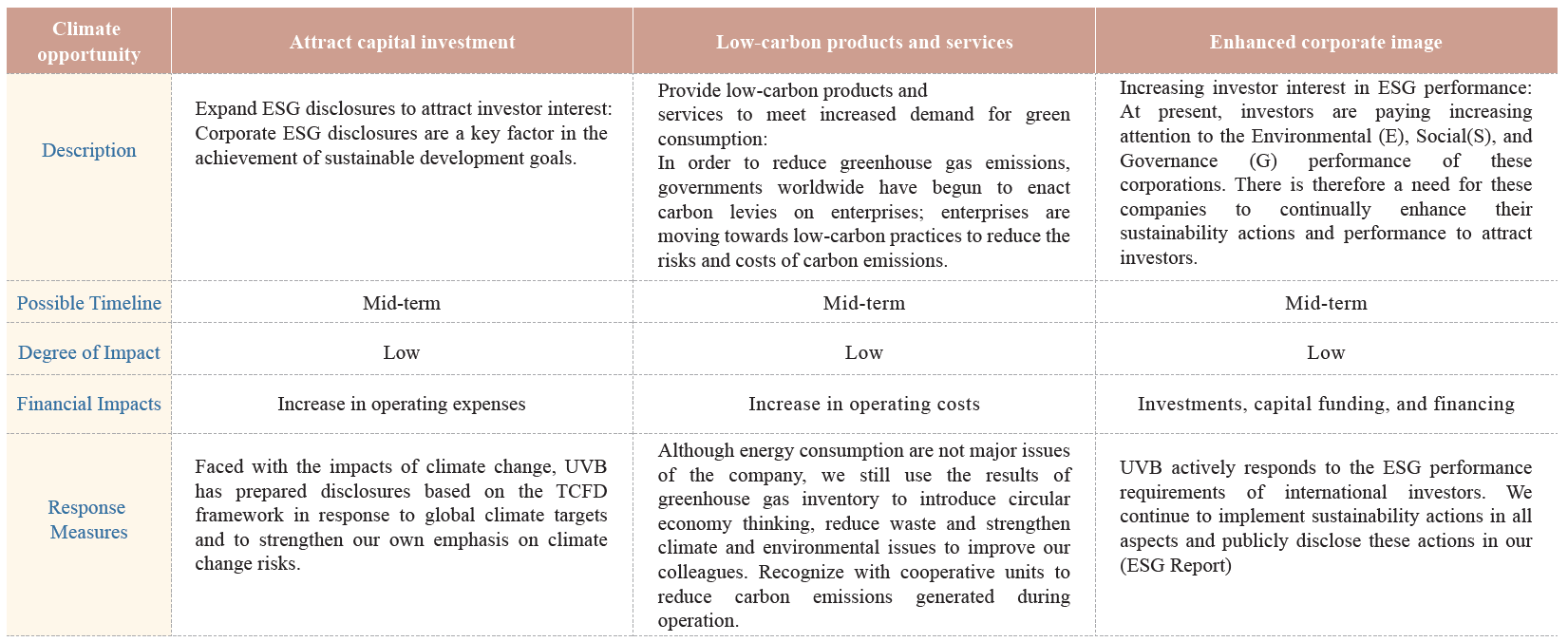

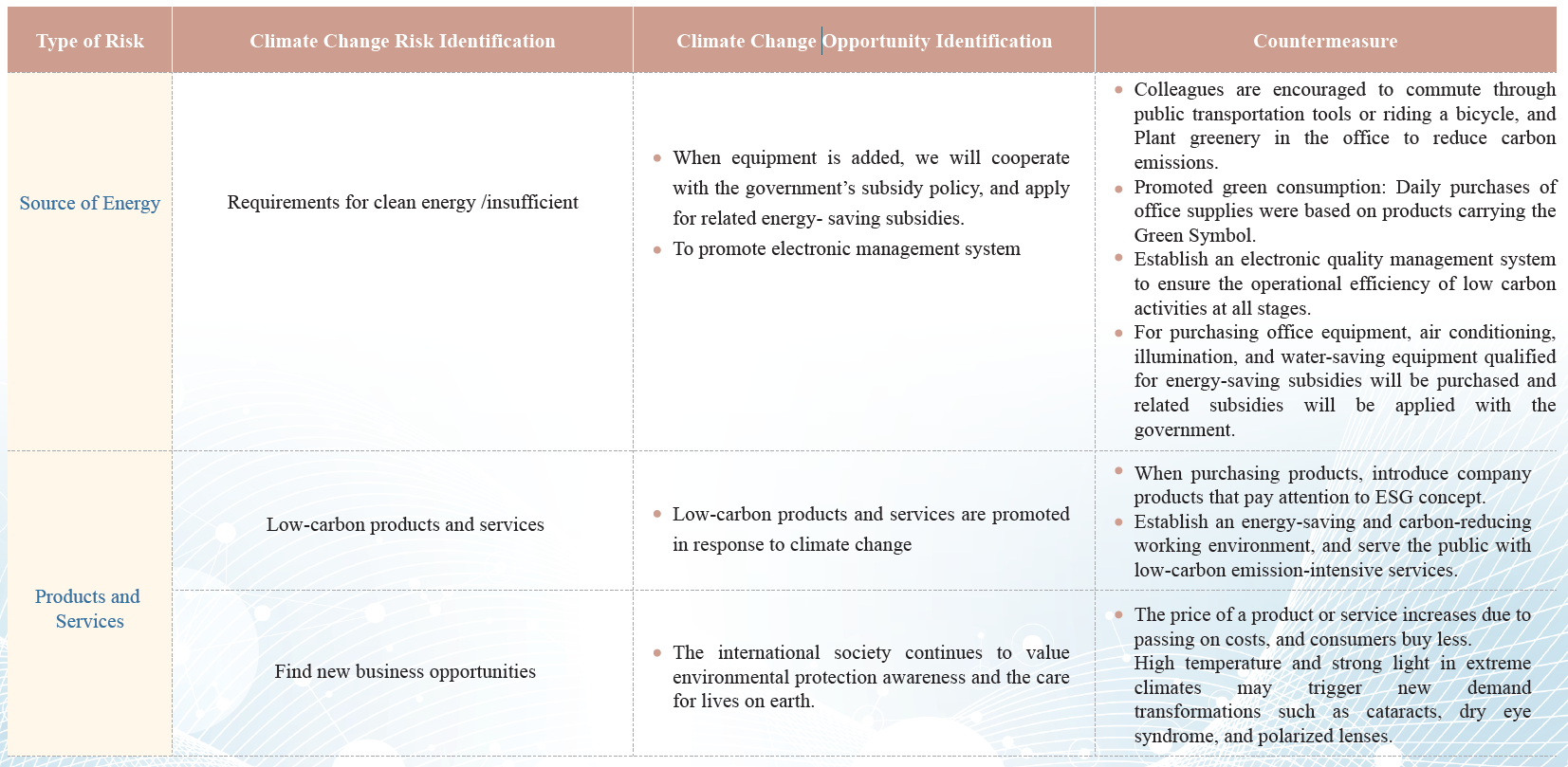

02 StrategyESG Office assessed significant climate risks and opportunities currently faced by UVB under the TCFD item. Subsequently, TCFD Material Topics was developed, which analyzes physical and transition risks that may occur over short, medium, and long-term timeframes, as well as relevant business opportunities. The company utilized this analysis to further formulate mitigation and adaptation strategies, enhancing the climate resilience of the organization. The results are as follows:

■ Climate Risk and Opportunity Analysis

■ Climate Risk and Opportunity Analysis

■ Scenarios for resilience

■ Scenarios for resilienceBased on the recommendations of the TCFD guidelines, we used the worst-case scenarios to assess the business impact of climate change, and incorporated the results into the risk management procedures to take appropriate adaptation actions.

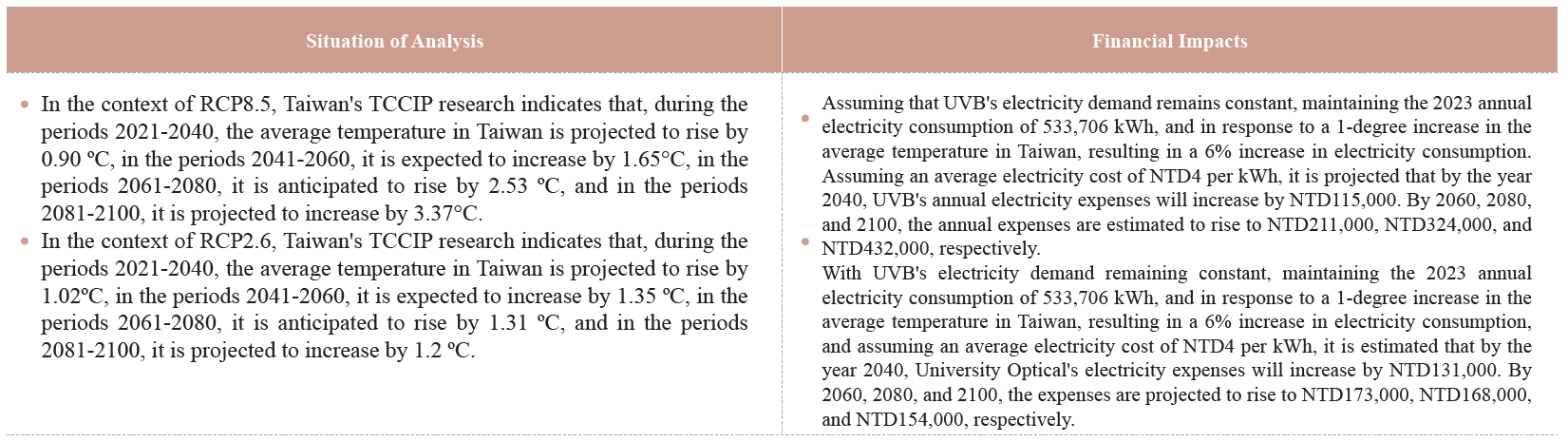

■ Analysis of Physical Risks of Climate ChangeIn accordance with the TCFD framework, UVB sets the benchmark scenario and the 2ºC scenario, and identifies and analyzes the short, medium and long-term climate risks and opportunities in the company's business scope and the entire life cycle of assets. In terms of transition risks, the university’s benchmark scenario and 2ºC scenario refer to the RCP8.5 and RCP 2.6 climate scenarios of the United Nations Panel on Climate Change (IPCC) respectively, and conduct risk assessments on immediate physical risks and long-term physical risks.

Immediate Physical Risk:Facility/equipment damages arising from and increased frequency and severity of severe typhoons Long-term Physical Risk:Increased energy consumption due to rising average temperature.

Long-term Physical Risk:Increased energy consumption due to rising average temperature. ■ Analysis of Transition Risks of Climate Change

■ Analysis of Transition Risks of Climate Change UVB is not an energy-intensive company and based on the risk identification procedure, transition risks will not have a significant impact on its operations. We still pay close attention to global climate-related measures and analyze the financial impact of the transition risks. Based on the assessment results, it can be determined that transition risks have no significant impacts on the Company’s operations. In order to mitigate the impact of transition risks, we persist in our efforts to implement various energy conservation measures and search for potential carbon reduction opportunities

03 Risk ManagementIn order to enhance the Company’s corporate governance, establish an effective risk management mechanism, assess and supervise the risk-taking ability and the current risk management situation, UVB expected to approve the “Risk Management Policies and Procedures” in 2023 as the Company’s highest guiding principle of risk management. Trough the policies and procedures, the Company integrates and manages various potential strategic, operational, financial and hazardous (climate change, legal compliance, market competition) risks that may affect operations and profitability, carries out risk warnings and takes appropriate preventive measures, or maintains operational activities in the event of an accident.

The responsible unit identifies relevant risk factors, analyzes the potential impact of each risk on the Company’s operations, and develops and adopts measures to control risks within the Company’s tolerable range. The board of Directors receives regular reports from the Risk Management Task Force and supervises the status of risk management execution by the Company and its important subsidiaries. The risk management results of 2023 were reported to the Board of Directors on May 9, 2024.

04 Metrics and Targets

04 Metrics and TargetsAlthough energy consumption, water use, and waste management are not major issues of the company, we still use the results of greenhouse gas inventory to introduce circular economy thinking, reduce waste and strengthen climate and environmental issues to improve our colleagues. Recognize with cooperative units to reduce carbon emissions generated during operation. The Company conducts risk identification for climate change, including analysis of risks and opportunities caused by direct or indirect impacts due to extreme weather, transition impacts of regulations, technology, or market demand, and other humanistic and social aspects on the Company’s operating activities. A risk management strategy plan is established based on the analysis results to serve as the core of climate change response actions, and relevant opportunities are identified to reduce risks and to seize business opportunities.

The evaluation results are hereby summarized as follows:

Climate Management Results and Goals

Climate Management Results and Goals